We invest conservatively, for the long-term. We desire to buy stocks, bonds and other assets at a discount to their true value (intrinsic value).

characteristics of a typical investment

There is no formula guaranteed to find undervalued investments that will outperform the market. We look for undervalued investments anywhere they can found. However, there are some characteristics that we typically see in many of our holdings, including:

Companies with a strong balance sheet, low debt/equity, high assets/liabilities (companies that are extremely unlikely to go bankrupt)

Companies that represent good value (low price/book, low price/earnings, companies that are selling at a discount to their intrinistic value)

Companies that pay dividends (in range-bound/sideways markets dividend payments make up 95% of returns)

“The single greatest edge an investor can have is a long-term orientation”

OUR typical holding period

We plan to hold investments for 10+ years. We almost always hold investments for at least 3 years. The reason for this is simple, over short time periods stock returns don't correlate to valuation (they are effectively random). However, as the time frame increases, returns to strongly correlate to value. To demonstrate this, the graphs below show real returns by CAPE (Cyclically adjusted price-to-earnings) ratio for 1 month, 1 year and 10 years.

One month returns are effectively random (not depended on the starting value of the security)

One year returns are less random than one year returns, but still effectively random

Ten year returns are clearly not random. A lower CAPE ratio at the time of purchase leads to a higher real return.

The graphs above are from equitablegrowth.org. Please read their fantastic article on the subject http://equitablegrowth.org/2014/08/17/circumstances-worry-stock-market-high-honest-broker-week-august-16-2014/.

Our Results

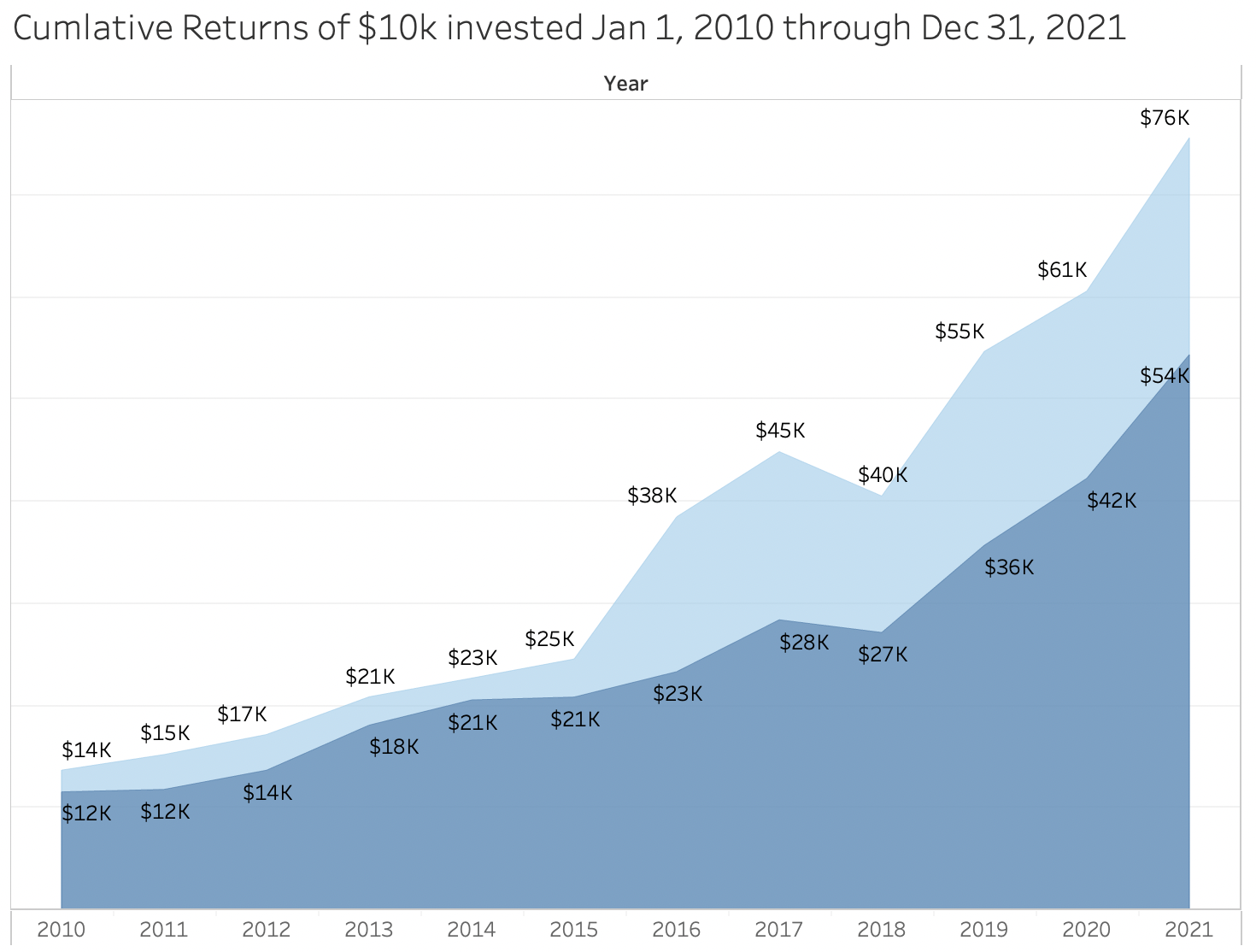

Our stock picks have an average annual return of 17% since 2008 (details below)

Our analysis has been used by Meb Faber and James Montier.

We founded the Northern Colorado Value Investor's Meetup.